Skip Market Makers, Create Instant Markets

Traditional exchanges face a bottleneck: every new product needs dedicated market makers. This creates delays,

fragmented liquidity, and limits innovation.

Amplified Liquidity solves this by connecting and aggregating

liquidity across related products. Instead of isolating each market, the system pools liquidity intelligently, creating

deeper, more responsive markets instantly. The result? Exchanges can launch any viable synthetic product immediately.

Calendar Spreads, Cross-Currency pairs, Complex Indices, all with robust liquidity from day one. No waiting, no

market maker recruitment, no compromises.

Amplified Liquidity solves this by connecting and aggregating

liquidity across related products. Instead of isolating each market, the system pools liquidity intelligently, creating

deeper, more responsive markets instantly. The result? Exchanges can launch any viable synthetic product immediately.

Calendar Spreads, Cross-Currency pairs, Complex Indices, all with robust liquidity from day one. No waiting, no

market maker recruitment, no compromises.

Benefits

Instant Market Creation

No waiting for liquidity providers. New synthetic markets go live immediately when there's demand

Deeper Liquidity

Pooled capital means tighter spreads and better fills across all products

Atomic Execution

Minimizes slippage and ensures multi-leg trades aren't left half-filled

Capital Efficiency

Market makers can concentrate resources where needed, rather than spreading thinly

Examples

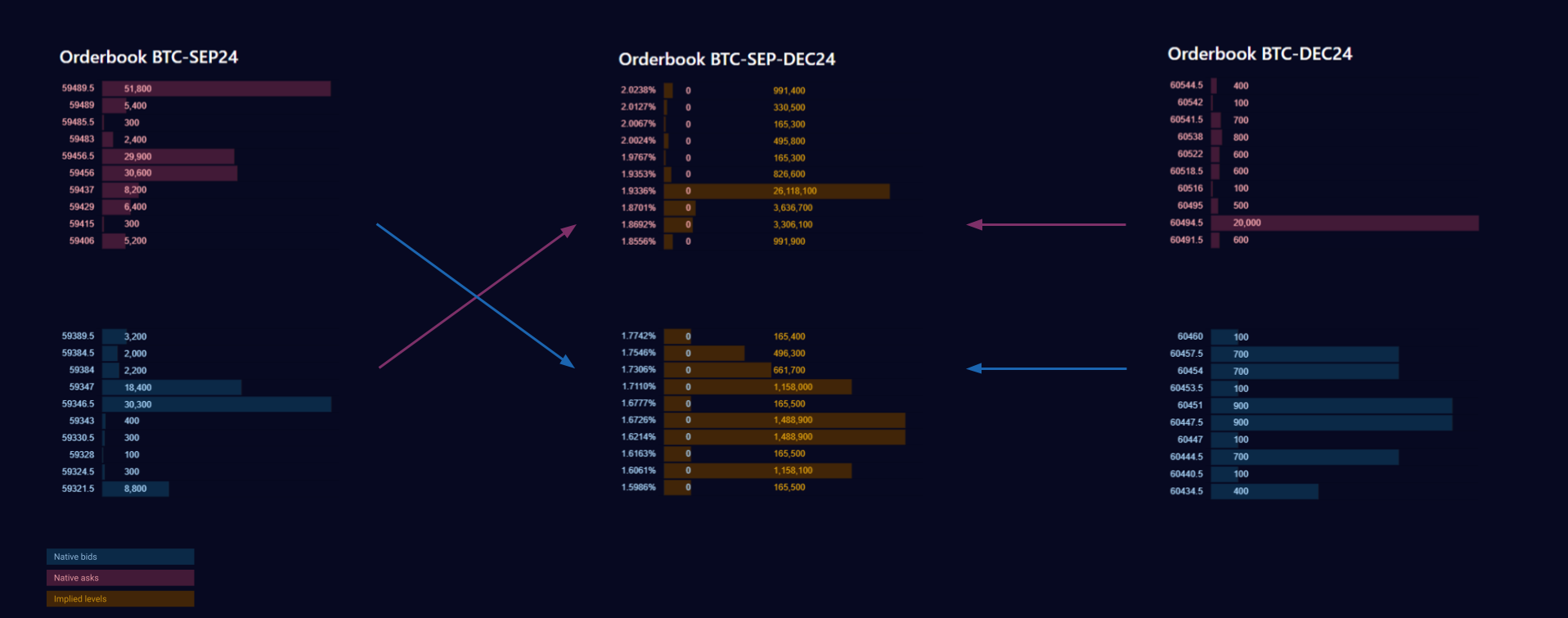

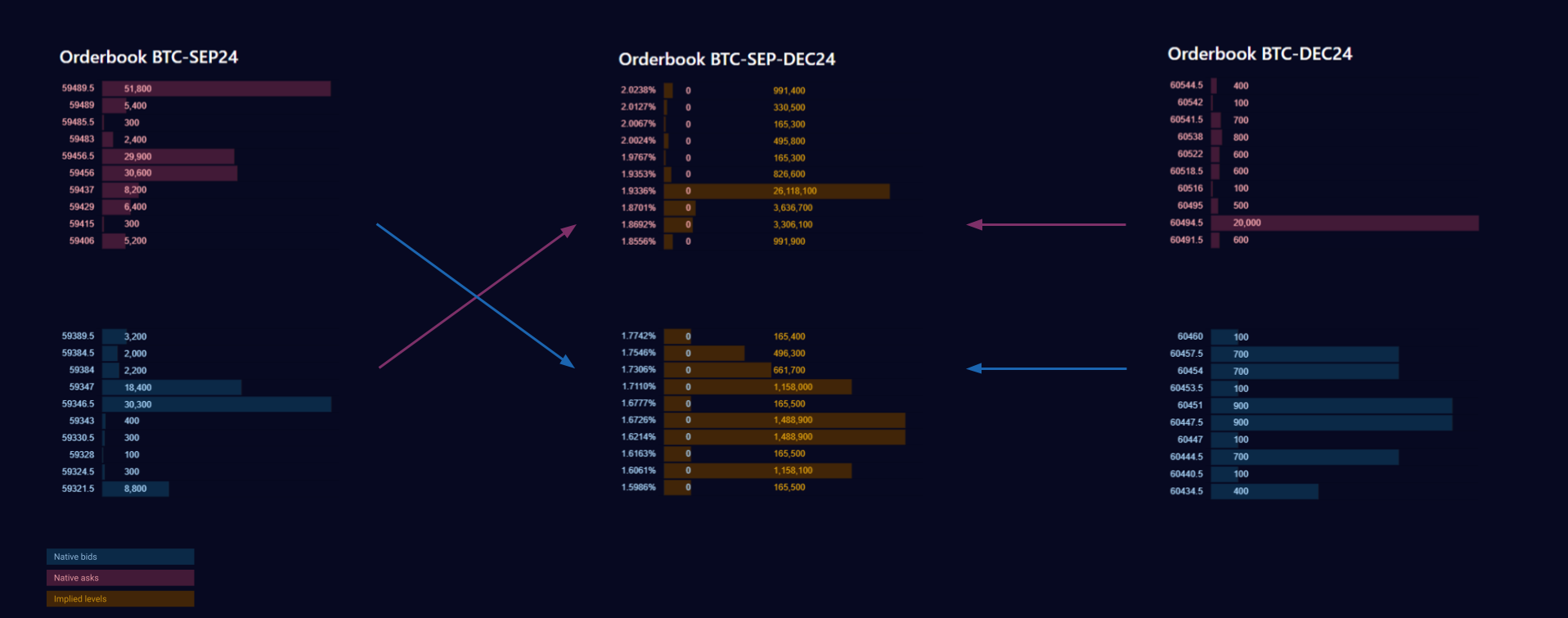

Calendar Spreads

Launch BTC perpetual-term spreads instantly. Liquidity drawn from

both underlying markets, executed atomically. The engine aggregates order books from BTCUSD perpetual and term futures,

creating synthetic spreads without dedicated market makers. Orders execute seamlessly across both legs with no slippage

risk.

Launch BTC perpetual-term spreads instantly. Liquidity drawn from

both underlying markets, executed atomically. The engine aggregates order books from BTCUSD perpetual and term futures,

creating synthetic spreads without dedicated market makers. Orders execute seamlessly across both legs with no slippage

risk.

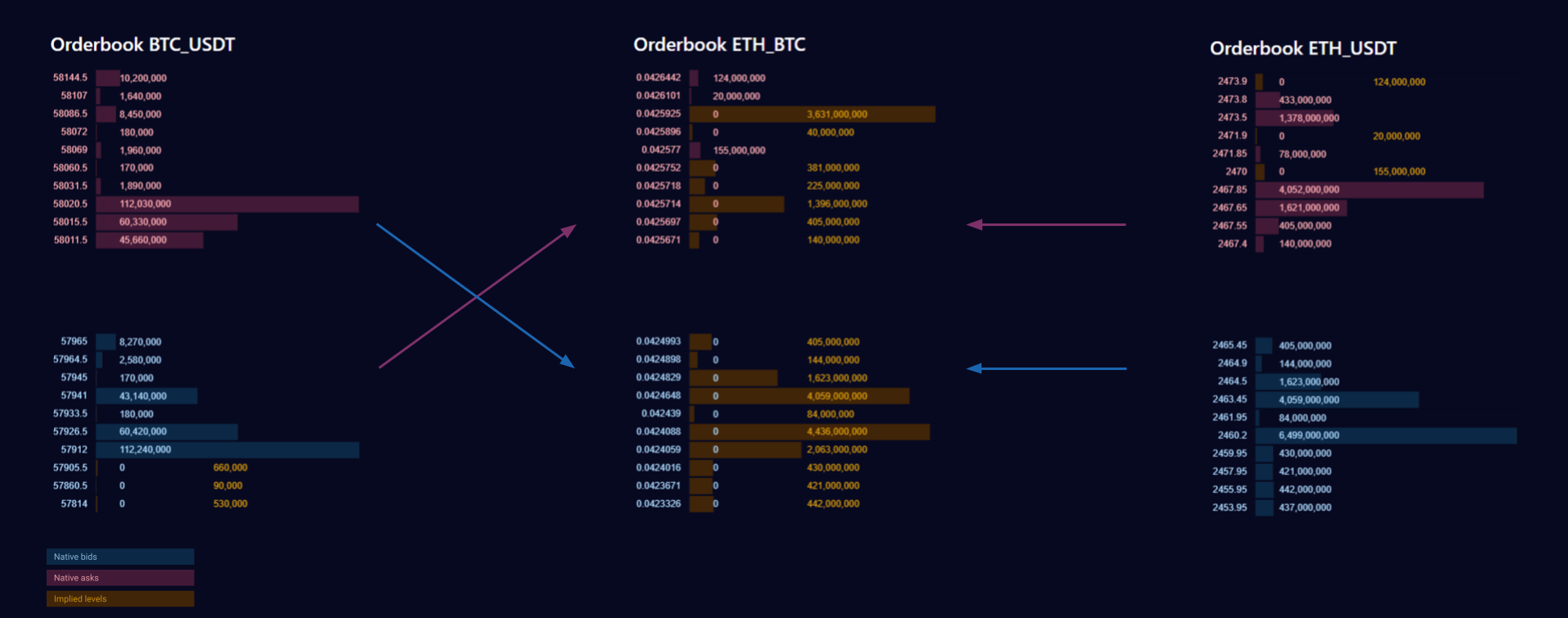

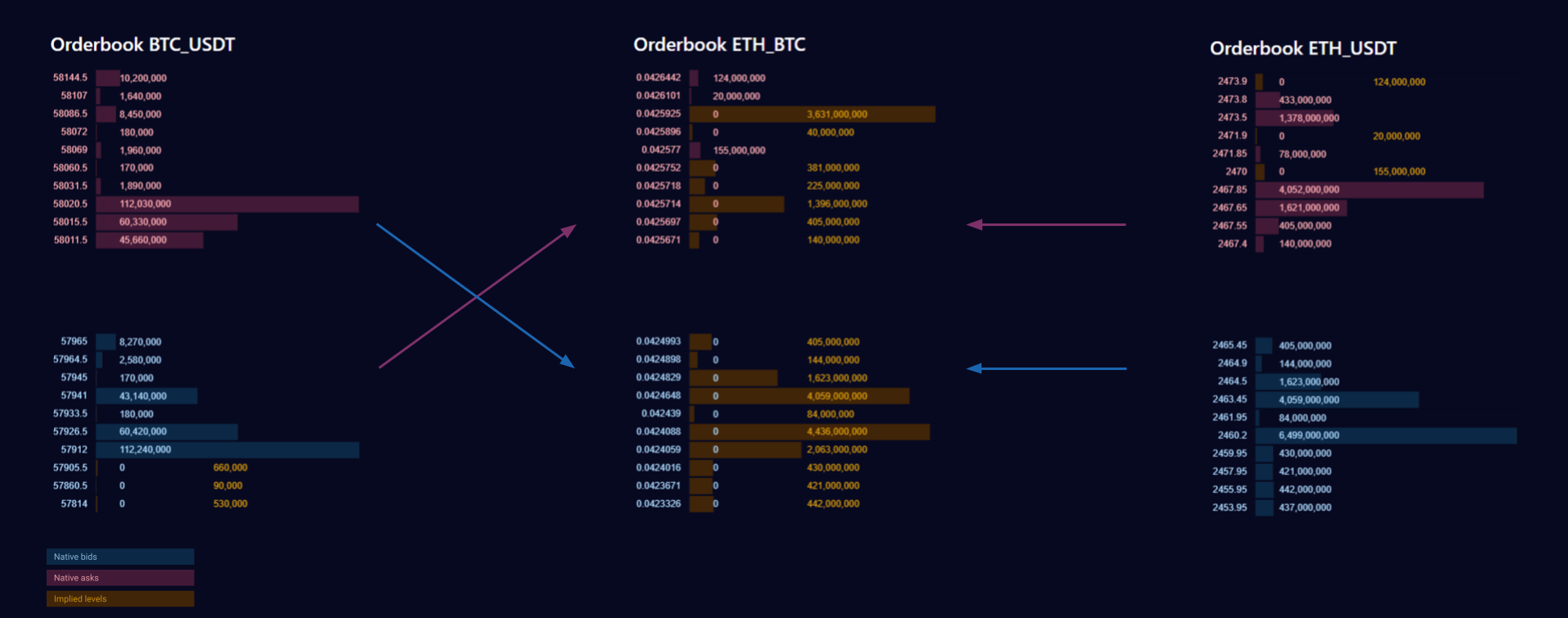

Cross-Currency Products

ETHBTC spot, synthesized from ETHUSD + BTCUSD spot markets. Better

execution than traditional cross-currency routing. The system automatically matches against optimal liquidity in both

underlying USD markets, delivering tighter spreads and deeper order books than standalone cross-currency pairs would

achieve.

ETHBTC spot, synthesized from ETHUSD + BTCUSD spot markets. Better

execution than traditional cross-currency routing. The system automatically matches against optimal liquidity in both

underlying USD markets, delivering tighter spreads and deeper order books than standalone cross-currency pairs would

achieve.

Complex Instruments

Indices and baskets derived from multiple underlying instruments with

configurable weights. Create crypto sector indices, DeFi baskets, or custom portfolio products instantly. Each component

contributes liquidity proportionally, ensuring robust markets for complex derivatives without requiring specialized

market makers for every combination.

Indices and baskets derived from multiple underlying instruments with

configurable weights. Create crypto sector indices, DeFi baskets, or custom portfolio products instantly. Each component

contributes liquidity proportionally, ensuring robust markets for complex derivatives without requiring specialized

market makers for every combination.